The Reverse Cup and Handle pattern is a unique formation in technical analysis that often indicates a reversal in the prevailing trend. While similar in structure to the traditional Cup and Handle pattern, it exhibits distinct characteristics and requires careful interpretation. In this comprehensive guide, we’ll delve into the intricacies of the Reverse Cup and Handle pattern, exploring its formation, identification, trading strategies, and more.

Introduction to Technical Analysis Patterns

Overview of Technical Analysis

Technical analysis is a method used by traders and investors to evaluate securities and forecast future price movements based on historical price data and trading volume.

Importance of Patterns in Trading

Patterns play a crucial role in technical analysis as they provide visual cues about market sentiment and potential price movements. Traders use patterns to identify trends, reversals, and entry/exit points in the market.

Understanding the Cup and Handle Pattern

Definition and Characteristics

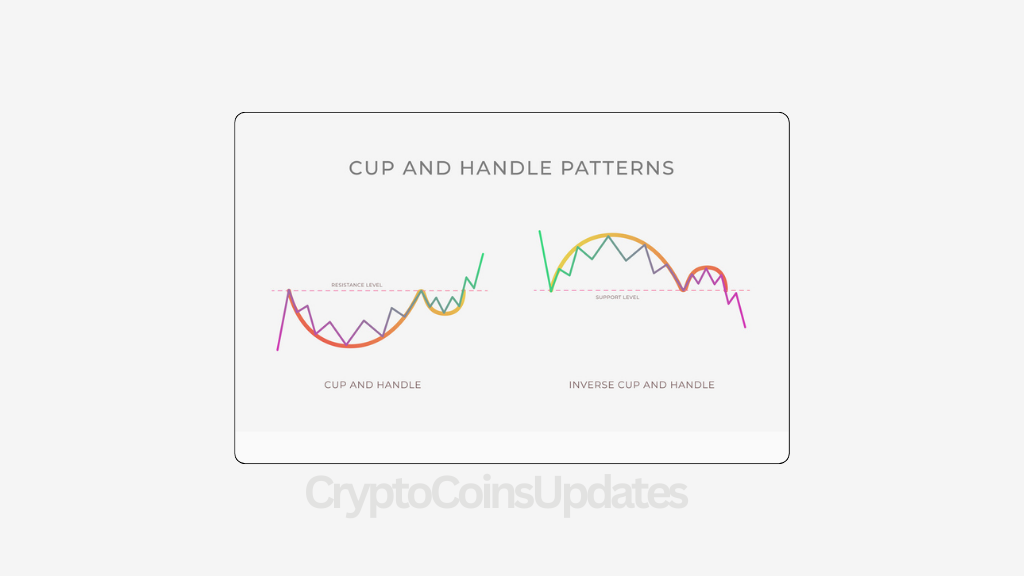

The Cup and Handle pattern is a bullish continuation pattern characterized by a rounded bottom (cup) followed by a consolidation period (handle) before resuming an upward trend.

Identification Criteria

To confirm the presence of a Cup and Handle pattern, traders typically look for specific criteria, such as the depth of the cup, the duration of the handle, and the volume profile during the pattern formation.

Introduction to the Reverse Cup and Handle Pattern

Definition and Concept

The Reverse Cup and Handle pattern is a bearish reversal pattern that mirrors the traditional Cup and Handle pattern but appears at the peak of an uptrend, signaling a potential trend reversal.

How It Differs from the Traditional Cup and Handle

While the traditional Cup and Handle pattern signals a continuation of the uptrend, the Reverse Cup and Handle pattern suggests a reversal of the prevailing bullish trend.

Anatomy of the Reverse Cup and Handle Pattern

Formation of the Cup

Similar to its bullish counterpart, the cup in the Reverse Cup and Handle pattern represents a period of consolidation or sideways movement after a prolonged uptrend.

Development of the Handle

After the formation of the cup, the price typically experiences a short-term rally followed by a retracement, forming the handle of the pattern.

Reversal Pattern Characteristics

The Reverse Cup and Handle pattern is characterized by a gradual decrease in price momentum and a shift in market sentiment from bullish to bearish.

Recognition of the Reverse Cup and Handle Pattern

Identifying Cup Formation

Traders look for a rounded or U-shaped price pattern followed by a period of consolidation, indicating a potential top formation.

Spotting the Handle Formation

The handle of the Reverse Cup and Handle pattern is formed as the price retraces from its recent peak, often accompanied by decreasing trading volume.

Confirmation Signals

Confirmation of the Reverse Cup and Handle pattern typically occurs when the price breaks below the support level established by the handle formation, signaling a bearish trend reversal.

Market Psychology Behind the Reverse Cup and Handle Pattern

Accumulation and Distribution Phases

During the cup formation, smart money accumulates shares, driving prices higher. The subsequent handle formation reflects profit-taking and distribution by traders and investors.

Shift in Market Sentiment

The emergence of the Reverse Cup and Handle pattern indicates a shift in market sentiment from bullish optimism to growing pessimism, as evidenced by the failure of the price to sustain its upward momentum.

Trading Strategies with the Reverse Cup and Handle Pattern

Entry Points and Stop-Loss Placement

Traders may consider entering short positions when the price breaks below the support level of the handle formation. Stop-loss orders can be placed above the resistance level to manage risk in case of a false breakout.

Setting Price Targets

Price targets for trades based on the Reverse Cup and Handle pattern can be determined by measuring the depth of the cup and projecting a potential downside target. Additionally, Fibonacci retracement levels or prior support zones may serve as additional price targets.

Risk Management Considerations

Risk management is essential when trading the Reverse Cup and Handle pattern. Traders should carefully consider their risk-to-reward ratio and position sizing to minimize potential losses.

Examples of Reverse Cup and Handle Patterns

Real-Life Case Studies

Examining historical price charts of various assets can provide valuable insights into the occurrence and effectiveness of the Reverse Cup and Handle pattern in different market conditions.

Chart Examples

Visual representations of the Reverse Cup and Handle pattern on price charts help traders understand its formation and recognize its significance in real-time trading scenarios.

Potential Pitfalls and Challenges

False Signals

As with any technical pattern, false signals can occur with the Reverse Cup and Handle pattern, leading to losses if traders fail to exercise caution and verify the validity of the pattern.

Market Volatility

High levels of market volatility can increase the likelihood of false breakouts or whipsaws, making it challenging to accurately identify and trade the Reverse Cup and Handle pattern.

Confirmation Bias

Traders may fall victim to confirmation bias, where they interpret price action to fit their preconceived notions of the Reverse Cup and Handle pattern, leading to suboptimal trading decisions.

Combining the Reverse Cup and Handle with Other Indicators

Moving Averages

Utilizing moving averages, such as the 50-period and 200-period moving averages, can help confirm the validity of the Reverse Cup and Handle pattern and provide additional confluence with other technical signals.

Volume Analysis

Analyzing trading volume during the formation of the Reverse Cup and Handle pattern can offer valuable insights into the strength of the pattern and the likelihood of a successful trend reversal.

Trendlines

Drawing trendlines on price charts can help traders identify key support and resistance levels, providing additional confirmation of the Reverse Cup and Handle pattern’s validity.

Backtesting and Validation

Historical Performance Analysis

Backtesting historical data can help traders assess the effectiveness of the Reverse Cup and Handle patterns in different market conditions and timeframes.

Paper Trading

Practicing trades based on the Reverse Cup and Handle pattern in a simulated trading environment allows traders to refine their strategies and gain confidence before executing trades with real money.

Tools and Resources for Identifying Reverse Cup and Handle Patterns

Charting Software

Utilizing advanced charting software with pattern recognition tools can help traders efficiently identify Reverse Cup and Handle patterns on price charts.

Pattern Recognition Tools

Pattern recognition algorithms and indicators within trading platforms can automatically detect Reverse Cup and Handle patterns, saving time and effort for traders.

Educational Materials

Accessing educational materials, such as articles, books, and online courses, can deepen traders’ understanding of the Reverse Cup and Handle pattern and enhance their trading skills.

Common FAQs About the Reverse Cup and Handle Pattern

How Reliable Is This Pattern?

While the Reverse Cup and Handle pattern can be a powerful tool for identifying trend reversals, its reliability depends on various factors, including market conditions and the quality of pattern formation.

Can It Be Applied to Different Timeframes?

The Reverse Cup and Handle pattern can be applied to different timeframes, from intraday charts to weekly or monthly charts, but traders should adjust their trading strategies accordingly based on the timeframe.

What Markets Are Suitable for Trading the Reverse Cup and Handle?

The Reverse Cup and Handle pattern can be found in various financial markets, including stocks, forex, commodities, and cryptocurrencies, making it versatile for traders across different asset classes.

Tips for New Traders

Practice Patience and Discipline

Patience and discipline are essential virtues for traders when identifying and trading the Reverse Cup and Handle pattern, as rushing into trades can lead to impulsive decisions and losses.

Start with Paper Trading

New traders should consider starting with paper trading to gain experience and confidence in trading the Reverse Cup and Handle pattern without risking real capital.

Continuously Educate Yourself

The financial markets are constantly evolving, so it’s crucial for traders to stay updated with the latest market developments and continuously educate themselves on trading strategies and techniques.

Conclusion

The Reverse Cup and Handle pattern is a valuable tool for traders seeking to identify trend reversals and capitalize on potential market opportunities.

Final Thoughts on Harnessing the Potential of the Reverse Cup and Handle Pattern

By understanding the formation, recognition, and trading strategies associated with the Reverse Cup and Handle pattern, traders can enhance their trading skills and improve their chances of success in the financial markets.