Terrapower, a cutting-edge nuclear energy company founded by Bill Gates, has been generating buzz in the energy sector with its innovative approach to clean energy production. Understanding the factors influencing Terrapower’s stock price is crucial for investors seeking to capitalize on the company’s potential growth trajectory. In this comprehensive analysis, we delve into the various aspects shaping Terrapower’s stock price and provide insights to help investors navigate the dynamic landscape of the energy industry.

A brief overview of Terrapower

Terrapower is a leading nuclear technology company focused on developing next-generation nuclear reactors to address global energy challenges.

Importance of stock price analysis

Analyzing Terrapower’s stock price provides investors with valuable insights into market sentiment, company performance, and growth prospects, guiding investment decisions.

Background of Terrapower

Founding and history

Terrapower was founded in 2006 by Bill Gates and a group of scientists with the vision of revolutionizing the nuclear energy sector.

Mission and goals

The company’s mission is to provide safe, affordable, and sustainable energy solutions to meet growing global energy demand while mitigating climate change.

Technological innovations

Terrapower’s innovative reactor designs, such as the traveling wave reactor (TWR) and molten chloride fast reactor (MCFR), promise enhanced safety, efficiency, and cost-effectiveness compared to traditional nuclear reactors.

Factors Influencing Terrapower’s Stock Price

Industry trends

Macro-level factors such as government policies, energy demand, and technological advancements in the nuclear industry impact Terrapower’s stock performance.

Economic conditions

Economic indicators, including interest rates, inflation rates, and GDP growth, influence investor sentiment and market demand for energy stocks like Terrapower.

Company performance

Terrapower’s operational performance, technological advancements, project milestones, and financial results directly affect its stock price movement.

Regulatory environment

Regulatory approvals, licensing agreements, and government support for nuclear energy policies play a significant role in shaping Terrapower’s regulatory landscape and stock price.

Historical Performance of Terrapower Stock

Initial public offering (IPO) details

Terrapower’s IPO details, including offering price, market capitalization, and trading debut, provide insights into investor sentiment and market reception.

Price fluctuations over time

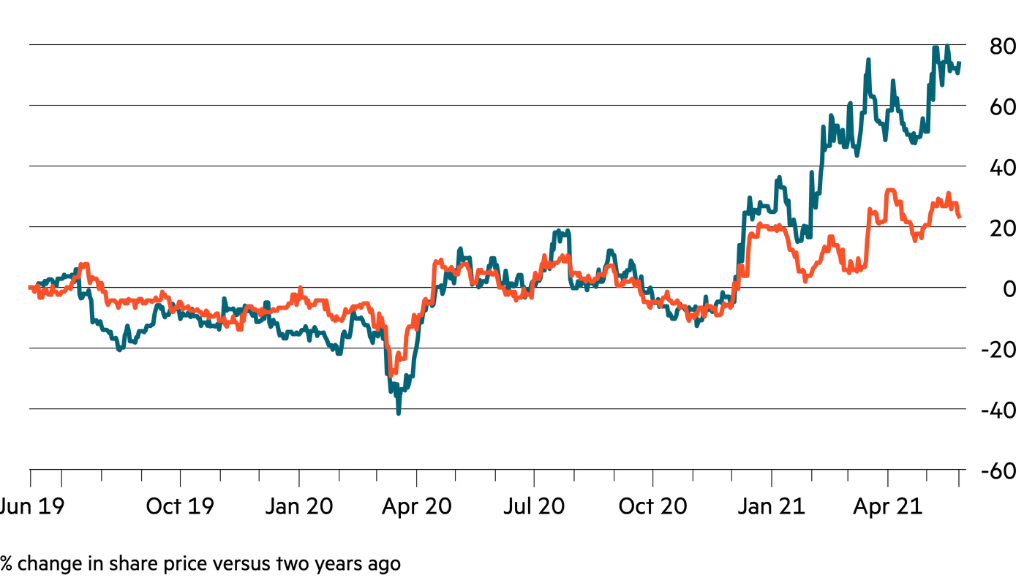

Analyzing Terrapower’s historical stock price data reveals patterns, trends, and volatility, offering clues about investor behavior and market dynamics.

Factors contributing to past trends

Identifying key events, announcements, and industry developments that influenced Terrapower’s stock price in the past helps forecast future performance.

Recent Developments and News

Major announcements

Recent announcements regarding partnerships, collaborations, technological breakthroughs, and project developments impact investor sentiment and stock price movement.

Partnerships and collaborations

Strategic alliances with industry partners, government agencies, and research institutions enhance Terrapower’s market positioning and growth prospects, influencing stock performance.

Technological advancements

Breakthroughs in reactor design, fuel cycle technology, and safety features contribute to Terrapower’s competitiveness and market appeal, driving stock price appreciation.

Analyst Ratings and Forecasts

Overview of analyst recommendations

Analyst ratings, price targets, and consensus forecasts provide valuable insights into market expectations and investor sentiment towards Terrapower’s stock.

Factors influencing analyst ratings

Analysts consider various factors such as industry trends, company fundamentals, technological innovations, and competitive positioning when assessing Terrapower’s stock.

Future projections

Analyst forecasts and long-term projections offer investors guidance on potential stock price appreciation and downside risks based on fundamental and technical analysis.

Technical Analysis of Terrapower Stock

Overview of technical analysis

Technical analysis tools and indicators, such as moving averages, relative strength index (RSI), and trend lines, help identify patterns and trends in Terrapower’s stock price chart.

Key technical indicators

Examining key technical indicators provides insights into investor sentiment, trading volume, and price momentum, aiding in decision-making for short-term traders and investors.

Chart patterns

Identifying chart patterns, such as support and resistance levels, triangles, and head and shoulders formations, assists in predicting future price movements and potential trend reversals.

Fundamental Analysis of Terrapower Stock

Overview of fundamental analysis

Fundamental analysis evaluates Terrapower’s financial health, growth prospects, competitive advantages, and industry positioning to determine its intrinsic value and investment potential.

Financial metrics and ratios

Analyzing financial metrics, including revenue growth, earnings per share (EPS), profit margins, and return on equity (ROE), offers insights into Terrapower’s financial performance and profitability.

Company fundamentals

Assessing Terrapower’s business model, management team, research and development capabilities, and intellectual property portfolio helps investors gauge its long-term viability and competitive advantage.

Comparison with Competitors

Overview of competitors in the industry

Identifying key competitors, such as nuclear energy companies, renewable energy firms, and traditional utilities, allows investors to benchmark Terrapower’s performance and market positioning.

Comparative analysis of stock performance

Comparing Terrapower’s stock performance with that of its peers, including revenue growth, market share, and valuation metrics, helps investors assess relative strength and weakness.

Strengths and weaknesses

Analyzing Terrapower’s competitive advantages, technological innovations, regulatory environment, and market opportunities relative to its competitors highlights its strengths and areas for improvement.

Investor Sentiment and Market Perception

Overview of investor sentiment

Tracking investor sentiment through social media, online forums, and sentiment analysis tools provides insights into market perception and sentiment towards Terrapower’s stock.

Media coverage and public perception

Media coverage, news articles, and public sentiment towards Terrapower’s projects, partnerships, and initiatives influence investor sentiment and stock price movement.

Impact on stock price

Positive or negative news events, analyst reports, regulatory developments, and industry trends impact investor sentiment and drive short-term fluctuations in Terrapower’s stock price.

Potential Risks and Challenges

Market volatility

Fluctuations in energy prices, geopolitical tensions, macroeconomic factors, and global events contribute to market volatility and affect Terrapower’s stock price stability.

Regulatory hurdles

Uncertainty surrounding nuclear energy regulations, licensing requirements, safety standards, and public perception poses regulatory risks and challenges for Terrapower’s projects and operations.

Competitive pressures

Intense competition from traditional energy sources, renewable energy technologies, and emerging nuclear startups presents challenges for Terrapower’s market positioning and growth prospects.

Technological setbacks

Delays in technological development, unexpected technical challenges, and unforeseen safety issues may disrupt Terrapower’s research and development efforts, impacting its stock price performance.

Investment Strategies and Recommendations

Short-term trading opportunities

Identifying short-term trading opportunities based on technical analysis, market trends, and news catalysts enables investors to capitalize on short-term price movements in Terrapower’s stock.

Long-term investment potential

Assessing Terrapower’s long-term growth prospects, technological innovations, industry trends, and competitive advantages helps investors identify potential multibagger opportunities for long-term investment.

Diversification strategies

Implementing diversification strategies, such as investing in a basket of energy stocks, ETFs, or index funds, helps mitigate single-stock risk and achieve a balanced investment portfolio.

Expert Opinions and Insights

Interviews with industry experts

Gaining insights from interviews with nuclear energy experts, industry analysts, and financial advisors offers valuable perspectives on Terrapower’s market positioning and growth prospects.

Insights from financial analysts

Leveraging insights from financial analysts, research reports, and investment newsletters provides investors with expert analysis and recommendations on Terrapower’s stock.

Recommendations for investors

Based on expert opinions and insights, investors can make informed decisions regarding Terrapower’s stock, considering factors such as risk tolerance, investment horizon, and financial goals.

Investor Education and Resources

Understanding stock market terminology

Educating investors on key stock market terms, concepts, and strategies, such as market orders, limit orders, and stop-loss orders, enhances their understanding and confidence in investing.

Tips for novice investors

Providing tips and guidance for novice investors, including setting realistic expectations, conducting due diligence, and practicing risk management, empowers them to make informed investment decisions.

Recommended resources for further research

Highlighting reputable sources, such as financial news websites, investment forums, and research platforms, enables investors to conduct further research and stay informed about Terrapower and the energy sector.

Conclusion

In conclusion, analyzing Terrapower’s stock price involves evaluating various factors, including industry trends, company performance, analyst ratings, and investor sentiment. While Terrapower presents significant potential for long-term investors seeking exposure to the nuclear energy sector, it is essential to conduct thorough research and consider diversification strategies to mitigate risks. With continued technological advancements, strategic partnerships, and regulatory developments, Terrapower remains well-positioned for growth, offering investors an opportunity to participate in the clean energy revolution.